We believe the credit loss provisioning under International Financial Reporting Standards 9 (“IFRS 9”) has been put to test by the sudden rise of economic uncertainty caused by COVID-19. We anticipate higher short-term provisioning volatility under IFRS 9 amid the pandemic. Nevertheless, such possible elevated volatility does not have a material impact on our fundamental credit views on Chinese banks.

IFRS 9 intends to reflect a forward-looking view on expected credit loss (“ECL”) through provisioning. Before IFRS 9, accounting rules typically conducted provisioning based on the incurred loss method. Chinese banks listed on the Hong Kong Stock Exchange have adopted IFRS 9 since January 1, 2018. About 30 Chinese banks are listed on the Hong Kong Stock Exchange, and thus need to follow IFRS 9. They accounted for about 68% of the total assets of China’s commercial banking sector as of the end of 2019.

Within the IFRS 9 impairment model, forecasts on future macroeconomic conditions and provisioning method for specific credit exposure are two major factors which may lead to potential volatility in provisioning amid COVID-19.

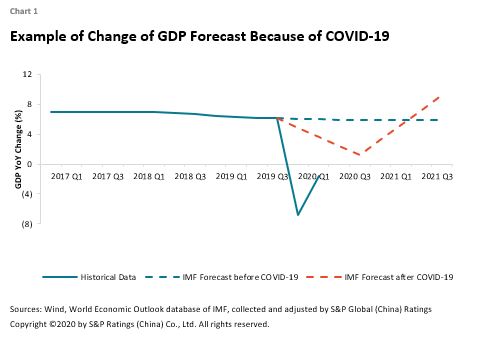

The downward pressure and uncertainty on GDP growth would be reflected in impairment charges under IFRS 9. Forecasts on future macroeconomic conditions are an integral part of the provisioning model under IFRS 9. Economists’ outlooks on GDP growth in 2020 have dropped significantly in recent months. When the lower GDP data are used as the model’s input, there may be some effect on the shape of the probability of default (“PD”) distribution, which may increase general provisioning pressure on all bank assets which require credit loss provisioning.

The provisioning method for specific credit exposure under IFRS 9 may also amplify the cyclical nature of banks’ impairment charges. Under IFRS 9, provisions are estimated based on the ECL for the entire remaining life of under-performing assets (stage 2 assets) and non-performing assets (stage 3 assets), but only based on the 12-month ECL for performing assets (stage 1 assets). The difference in ECL calculation methods when an asset migrates from stage 1 to stage 2/3 may lead to a sharp increase in impairment charges (see Appendix 1 for details). Such impact may be small in regular times, but may potentially be significant under COVID-19, with many borrowers hit by the pandemic at the same time.

In addition, making a reliable ECL forecast for borrowers in hard-hit sectors has become more challenging given the high uncertainty over the trajectory of the pandemic. The provisioning pressure on different industries varies and we anticipate higher pressure in the aviation, tourism, restaurant and recreation sectors as well as among small and medium-sized enterprises. Therefore, the provisioning pressure on banks will differ based on their respective portfolio concentration.

Due to the challenges concerning quantitative assessment, we believe, in the short term, qualitative assessment by the management is an important input in provision modeling. We expect banks’ management teams to mitigate impairment charge volatility after they incorporate government support for the real economy into their assessments.

Nevertheless, from a credit perspective, the possible weakening of internal capital generation capacity resulting from higher provisioning is compensated by a corresponding increase in banks’ reserve buffers. Therefore, any earning volatility caused by IFRS 9 provisioning does not have a material impact on banks’ overall capitalization. It is more important to assess the actual credit cost of the pandemic, but the extent of its actual impact is still too early to tell. Before COVID-19, the initial adoption of IFRS 9 in 2018 had no significant impact on Chinese banks’ capital levels (see appendix 2 for details).