Energy Industry

English Summary:

SCOPE AND OVERVIEW

This methodology represents S&P Global (China) Ratings' supplemental methodology and assumptions for rating energy entities. Subsectors that would typically be covered by this energy supplemental methodology may include oil and gas exploration and production, oil refining and marketing, midstream energy, services and equipment and contract operator, and unregulated power and gas. This energy supplemental methodology is typically applied in conjunction with S&P Global (China) Ratings Corporate Methodology.

This methodology may also apply to other sectors that we deem appropriate for its use, given the characteristics of the sector, or where we believe an individual issuer or issue is best suited to be analyzed using this supplemental methodology.

METHODOLOGY

Business Risk Analysis

Industry Risk

Our industry risk analysis typically considers industry cyclicality, and competitive risk and growth. Industry cyclicality typically considers exposure to economic, business and other cyclical influences and how these may affect revenues and profitability. Competitive risk and growth looks at the effectiveness of industry barriers to entry; the level and trend of industry profit margins; the risk of secular change and substitution of products, services, and technologies; and the risk in growth trends.

Exploration And Production

This sector covers entities that typically derive a majority of their revenues from the development and production associated with oil and natural gas hydrocarbons. It can also include integrated oil and gas entities with downstream (refining and marketing) and midstream businesses.

Midstream Energy

This sector covers entities that typically derive a majority of their revenues from the transporting, processing, storage, and marketing of commodities such as crude oil, refined products (e.g., gasoline and diesel), natural gas, and natural gas liquids (NGLs) or other commodities like ethanol or coal.

Oil Refining And Marketing

Oil refining covers entities that typically derive a majority of their operating cash flow from the process of refining crude oil into various oil-related refined products such as gasoline, diesel, and jet fuel. Marketing covers entities that are typically wholesale suppliers of refined products, such as gasoline and diesel, to retail outlets.

Services and Equipment and Contract Operators

This sector covers entities that typically get most of their revenues from the capital spending of the exploration and production industry.

Unregulated Power and Gas

This sector covers entities that typically generate and sell electricity, or buy and resell power and/or gas in some combination of energy or capacity, through bilateral agreements with utilities and other intermediaries, or directly to end-consumers or to a market administrator or system operator.

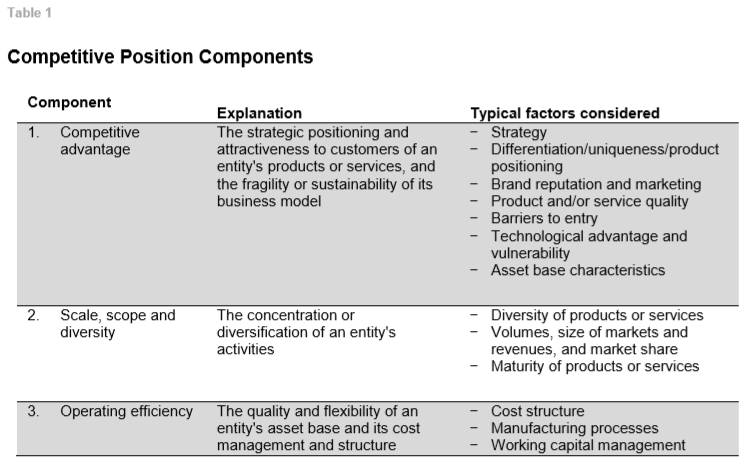

Competitive Position (Including Profitability)

In analyzing the competitive position for energy entities, we typically consider an individual entity's:

a) Competitive advantage.

b) Scale, scope, and diversity.

c) Operating efficiency.

d) Profitability.

The factors that we may typically analyze when considering competitive position are described below:

a) Competitive Advantage

- In analyzing the competitive advantage of an exploration and production entity, we typically consider its growth prospects inherent in its acreage, the mix of liquids and gas produced, the unit revenues realized at each producing region; and the extent of vertical integration, if any, among operating segments.

- In analyzing the competitive advantage of a midstream energy entity, we typically consider the resiliency of volume flows; the contract profile; commodity price exposure; and the regulatory framework under which the entity operates.

- In analyzing an oil refiners and marketing entity, competitive advantage is generally of limited importance in our analysis. This is because refiners buy and sell commodities that have little, if any, competitive edge or profitability difference due to product differentiation or brand name.

- In analyzing the competitive advantage of a services and equipment and contract operators entity, we typically consider the technological complexity of its services and equipment, the product's value or importance to customers, ability to quickly service or replace equipment, the services and equipment pricing power or susceptibility to price competition, and relative market position in its market segment.

- In analyzing the competitive advantage of an unregulated power and gas entity, we typically consider market structure and attractiveness, earnings structure and stability, and asset mix and quality/technological advantage.

b) Scale, scope, and diversity

- In analyzing the scale, scope, and diversity of an exploration and production entity, we typically consider its the size of the reserves (larger reservoirs leads to economies of scale); the makeup in terms of liquids (such as crude oil and natural gas liquids) rather than natural gas; the operational risk inherent in the exploitation of the reserves (for example, deep water production being much riskier than onshore operations); the geographic diversity of production sources; and the entity's current production and future growth prospects.

- In analyzing the scale, scope, and diversity of a midstream energy entity, we typically consider operating scale and geographic diversity; diversity of commodity exposure; integration with other complementary business lines; and diversification of the customer base.

- In analyzing the scale, scope, and diversity of an oil refiners and marketing entity, we typically consider total refining capacity, number of refineries and degree of reliance on a single refinery to generate earnings; geographic footprint (for instance feedstock supply diversity, specifically from a logistics standpoint), and access to attractive demand markets; complexity and product mix; and degree of midstream/downstream integration and extent of marketing operations.

- In analyzing the scale, scope, and diversity of a services and equipment and contract operators entity, we typically consider the relative size of its revenue and EBITDA, the depth and breadth of its product offerings, the geographic balance of its sales and EBITDA, and its degree of customer concentration.

- In analyzing the scale, scope, and diversity of an unregulated power and gas entity, we typically consider the relative size of operations, earnings, and cash flow, the degree of market diversity, the breadth of the asset mix (including fuel type and plant diversity), the degree of supplier or customer concentration, and the degree of vertical integration both forward (retail) and backwards (generation and/or fuel).

c) Operating efficiency

- In analyzing the operating efficiency of an exploration and production entity, we typically consider unit costs relative to those of peers; unit margins; and revenue per unit of production relative to unleveraged costs.

- In analyzing the operating efficiency of a midstream energy entity, we typically consider the scalability of growth-oriented capital spending; the size of maintenance capital spending relative to the overall capital spending budget; the cost profile of operating assets; and the degree of asset utilization.

- In analyzing the operating efficiency of an oil refiners and marketing entity, we typically consider operating and processing costs, including age of the refinery, retrofitting or upgrades to equipment, and fuel costs, which can vary by region; utilization rates; operating flexibility relative to that of its peers; unplanned outages; and ability to source feedstock and market product.

- In analyzing the operating efficiency of a services and equipment and contract operators entity, we typically consider the flexibility of the cost structure; working capital needs during times of weak market conditions; and efficiency and quality of equipment manufacturing.

- In analyzing the operating efficiency of an unregulated power and gas entity, we typically consider its cost competitiveness, asset efficiency, and the flexibility of its cost structure in absorbing demand declines (operating leverage) or input cost pressures, and its cost management.

d) Profitability

In analyzing the entity’s profitability, we typically consider the level of profitability and the volatility of profitability over a medium to longer term timeframe. If the entity has limited historical data, we may look at its peers operating in the same sector and use it as a proxy.

Financial Risk Analysis

In analyzing the cash flow adequacy of an Energy issuer, our analysis generally uses similar methodology as with other corporate issuers (see "S&P Global (China) Ratings Corporate Methodology").

Core ratios

In analyzing the cash flow/leverage of energy entities, we typically use these core ratios: FFO-todebt and debt-to-EBITDA.

Supplemental ratios

In addition to our analysis of an entity's core ratios, we may consider supplemental ratios to develop a fuller understanding of its credit risk profile and refine our cash flow analysis

For entities operating in the energy industry, we may use free operating cash flow (FOCF) to debt as the preferred supplemental ratio. This is because working capital and capital spending cycles can significantly shape these entities' cash flow generation patterns. We may also use discretionary cash flow-to-debt for issuers who pay out a portion of excess cash flow to shareholders as dividends. In addition, we may use other ratios as we deem appropriate, such as debt service coverage ratios (FFO + interest to cash interest, or EBITDA to interest).

OTHER CONSIDERATIONS

This methodology is not intended to be an exhaustive list of all factors we may consider in our analysis. Where appropriate, we may apply additional and/or different, quantitative and/or qualitative, considerations in our analysis to reflect the circumstances of the analysis for a particular issuer, issue or security type. A rating committee may adjust the application of the methodology to reflect individual circumstances in our analysis.