Understanding S&P Global (China) Ratings Insurance Methodology

Introduction

The S&P Global (China) Ratings Insurance Methodology is constructed to describe the key areas that we would typically consider when analyzing the credit quality of insurance companies or similar institutions in China.

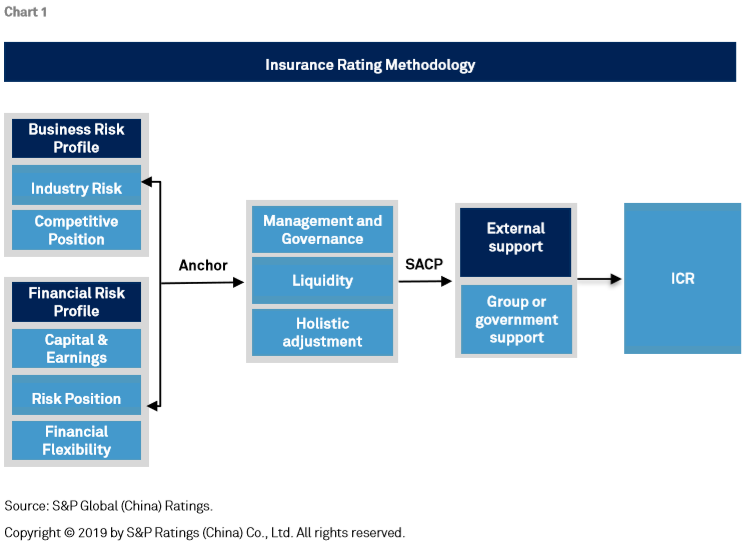

To assess an insurer’s credit quality, we typically start from analyzing its business risk profile (BRP) and financial risk profile (FRP), and combine the assessment of both to determine its anchor. We then derive its standalone credit profile (SACP) based on its anchor and assessments on other factors, such as liquidity position and management and governance. When relevant to an insurer’s credit quality, we may also consider the possible external support it may receive from government or group, before arriving at the issuer credit rating (ICR).

This methodology may be used together with other S&P Global (China) Ratings methodologies, such as our General Considerations on Rating Modifiers and Relative Ranking Methodology which considers common external factors that may influence the ICR or issue-level rating.

This methodology may be used together with other S&P Global (China) Ratings methodologies, such as our General Considerations on Rating Modifiers and Relative Ranking Methodology which considers common external factors that may influence the ICR or issue-level rating.