Commentary: Understanding S&P Global (China) Ratings Approach To Support

Analytical Contacts

May Zhong | Senior director for corporate ratings | may.zhong@spgchinaratings.cn

Ying Li | Director for financial institutions ratings | ying.li@spgchinaratings.cn

Kan Zhou | Senior director for structured finance ratings | kan.zhou@spgchinaratings.cn

Peter Eastham | Managing director | peter.eastham@spgchinaratings.cn

Introduction

The S&P Global (China) Ratings has developed a singular common framework to consider support across all practices.

When assessing an entity’s credit quality, we usually consider its credit profile on a stand-alone basis. When relevant to an entity’s credit quality, we also consider its relationships with external or related entities, usually the government and group, before arriving at the final rating.

An issuer’s relationship with a stronger entity, which we believe may provide support, may enhance the issuer’s credit quality. Conversely, a relationship with a weaker entity may limit an issuer’s credit quality if we believe the related entity is likely to and has the ability to interfere with the operations of the issuer. In most cases, the effect on credit quality is positive because the government or group has greater resources and therefore stronger credit quality.

We typically consider three key elements during our support analysis: credit quality of the issuer on a stand-alone basis, credit quality of the related entity, and the relationship between the issuer and relevant group or government.

Single Approach To Support

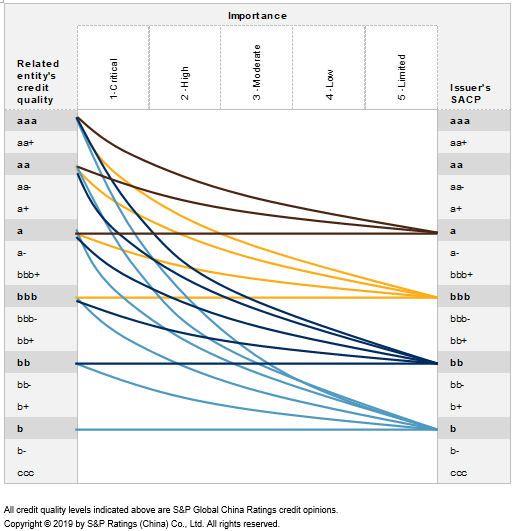

The following diagram illustrates the relationship between the level of importance and rating uplift of varying differential between the issuer’s stand-alone credit quality (SACP) and the related entity’s credit quality.

We believe strength of support is correlated to the level of importance an issuer has to the related entity. We consider level of importance may be critical, high, moderate, low, or limited. As the level of importance increases, so does the potential for an uplift to the issuer rating where the provider demonstrates higher credit quality. Each level of importance has a range of outcomes, with the widest range in the critical category.

Our starting point is usually the mid-point of the corresponding section on the curve; however, it may be higher when the importance level is assessed as critical, with the flexibility to adjust up or down within that category. For instance, for government-related entities (GRE), the adjustment may reflect peer comparisons of the contribution to the respective government’s GDP or employment, or other factors. We may determine an outcome that does not fall on the curve when we deem it appropriate.

Support Assessment When Related Entity Is A Government

When it is in a government’s interest for an entity to remain in operation and have access to capital, we typically consider it may provide some form of support to the entity.

For some entities, a government’s support is explicit and even public. Such support typically includes cash or equity infusions and indicates relatively high levels of importance of the entity to the government. For other entities, a government may broker or direct actions to be taken that favor one market player over another. Similarly, the government may encourage other GREs or lower level government bodies to provide support to an issuer.

Characteristics that may increase an entity’s importance to a government include those that contribute to the key policy, strategic and stability objectives of the government’s jurisdiction. We may view an entity as of critical or high importance to a government if it is a non-severable arm of or controlled by the government, executes government initiatives, and provides services that are not easily replaceable, and any default could have a large impact on the local economy. An entity may be considered as of moderate importance to the related government if it is a leading but not a premier operator in the industry, does not provide a public service, and its default would cause a relatively large impact on the local economy. An entity may be considered as of low or limited importance to its related government if there is evidence that the government may not support the entity, or if we believe the government is likely to sell the company.

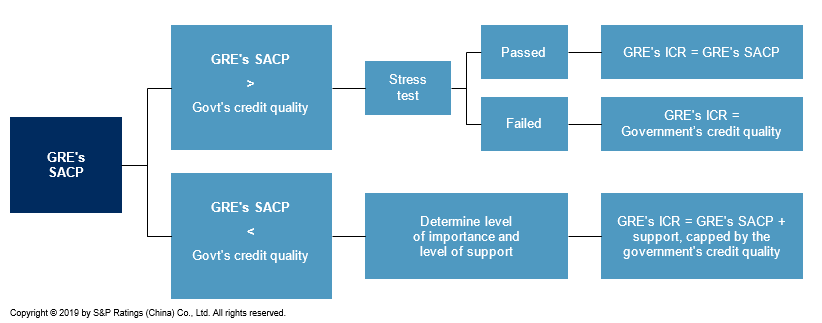

We may use the following decision tree to illustrate the analysis of government influence for most GREs.

In many cases, the support reference is the stand-alone credit quality of the relevant government, unless we believe the entity is likely to benefit from support from a higher level of government.

When a GRE’s stand-alone credit quality is better than the credit quality of its relevant government, we consider whether economic stress of the government or its jurisdiction is likely to have a negative impact on the GRE, potentially capping the GRE’s Issuer Credit Rating (ICR). We typically consider the extent of the GRE’s operations outside of the relevant government’s jurisdiction when assessing the GRE’s likelihood of withstanding localized stress.

By rating a GRE above its related government, we believe the GRE's ability and willingness to service its debt is superior to that of the government and that, ultimately, if the government defaults, there is a measurable likelihood that the GRE would not default. In order to do so, the GRE may need to pass the stress test and is typically not critical to the government.

Support Assessment When Related Entity Is Group

The importance an entity has to a group depends on its role in the related group’s strategy and the extent of any adverse effect that would result from letting the entity fail.

Indications of an entity’s importance to a group include sharing a common name, contributing a good proportion of the group’s operations, management’s long-term commitment to support the entity, and synergies and operational ties between the entities.

We may view an entity as having critical importance to a group if it operates in lines of business that are closely aligned with the group's mainstream business and markets, has a strong, long-term commitment of support from senior group management, constitutes a significant proportion of the consolidated group, or is fully integrated with the group. We may consider an entity’s importance level to fall into other categories if we believe the support from group is not committed, could be limited to certain circumstances, or is even in doubt.

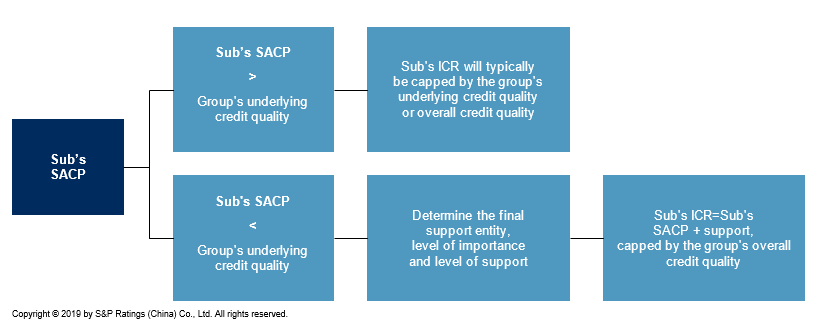

We may use the following decision tree to illustrate the analysis of group influence for most subsidiaries.

In many cases, the support reference is the credit quality of the support provider on a stand-alone basis, unless we view the entities’ criticality to the group would also be acknowledged by the government.

In certain circumstances, both group support and government support may be separately applied where we believe an entity’s likelihood of support is beyond that of the group, and it may receive support from a government that may or may not provide equivalent support to the parent. In these cases, we typically select the higher rating outcome.

The influence of a group can affect an entity’s credit quality in different ways and to different extents. In the same way that we attribute different levels of support to an entity’s credit quality, we may attribute different levels of interference. We may reflect the risk of interference from a group by notching down on an entity rating from its stand-alone credit quality, and in some cases may equate the rating with the group’s credit quality. However, when we have reason to believe interference is unlikely or remote, due to strength of the group’s credit quality, we may limit the downward notching or not notch down the rating from the subsidiary’s stand-alone credit quality.

Copyright © 2019 by S&P Ratings (China) Co., Ltd. All rights reserved.

S&P Ratings (China) Co., Ltd. (“S&P”) owns the copyright and/or other related intellectual property rights of the abovementioned content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content). No Content may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P. The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and / or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgement at any time and in its sole discretion. S&P disclaims any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web site www.spgchinaratings.cn, and may be distributed through other means, including via S&P publications and third-party redistributors.

Australia:

S&P Global Ratings (Australia) Pty. Ltd. holds Australian financial services license number 337565 under the Corporations Act 2001. S&P credit ratings and related research are not intended for and must not be distributed to any person in Australia other than a wholesale client (as defined in Chapter 7 of the Corporations Act).

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor’s Financial Services LLC.